Greater Expenses: SDIRAs frequently include larger administrative expenses as compared to other IRAs, as selected elements of the executive approach can't be automated.

Consider your Mate might be commencing another Fb or Uber? With the SDIRA, you can put money into triggers that you think in; and perhaps get pleasure from larger returns.

Relocating cash from one particular kind of account to another form of account, such as shifting money from a 401(k) to a traditional IRA.

The main SDIRA principles with the IRS that buyers have to have to grasp are investment restrictions, disqualified individuals, and prohibited transactions. Account holders have to abide by SDIRA rules and restrictions so that you can preserve the tax-advantaged standing of their account.

Before opening an SDIRA, it’s crucial that you weigh the opportunity advantages and disadvantages dependant on your unique economic plans and risk tolerance.

SDIRAs in many cases are used by hands-on investors who're ready to tackle the risks and duties of choosing and vetting their investments. Self directed IRA accounts will also be great for investors who may have specialized know-how in a distinct segment industry that they would like to put money into.

Consumer Help: Look for a service provider that gives committed aid, including use of knowledgeable specialists who will answer questions on compliance and IRS rules.

Put simply just, for those who’re seeking a tax successful way to create a portfolio that’s much more customized for your pursuits and skills, an SDIRA might be the answer.

Opening an SDIRA can give you use of investments normally unavailable by way of a bank or brokerage agency. Here’s you can check here how to begin:

Have the freedom to take a position in Just about any kind of asset that has a danger profile that matches your investment approach; which includes assets that have the probable for a better rate of return.

An SDIRA custodian is different as they have the appropriate personnel, expertise, and capability to keep up custody of the alternative investments. The first step in opening a self-directed IRA is to find a service provider that is click this site specialised in administering accounts for alternative investments.

And since some SDIRAs for instance self-directed common IRAs are issue to necessary bare minimum distributions (RMDs), you’ll ought to prepare ahead to make certain you might have adequate liquidity to fulfill The principles set via the IRS.

In some cases, the charges affiliated with SDIRAs might be higher and a lot more complicated than with an everyday that site IRA. This is due to in the amplified complexity related to administering the account.

As a result, they tend not to promote self-directed IRAs, which offer the flexibility to invest in a broader selection of assets.

Ease of Use and Technology: A consumer-pleasant System with on the web resources to trace your investments, submit paperwork, and control your account is very important.

Though there are various Gains related to an SDIRA, it’s not without having its possess downsides. Many of the popular main reasons why buyers don’t opt for SDIRAs include things like:

Due Diligence: It really is named "self-directed" for your rationale. With an SDIRA, you're fully accountable for carefully looking into and vetting investments.

Entrust can aid you in purchasing alternative investments using your retirement cash, and administer the obtaining and promoting of assets that are usually unavailable as a result of financial institutions and brokerage firms.

IRAs held at banking institutions and brokerage firms offer limited investment choices for their clients because they do not have the experience or infrastructure to administer alternative assets.

Ben Savage Then & Now!

Ben Savage Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Kirk Cameron Then & Now!

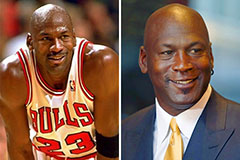

Kirk Cameron Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!